Technical Analysis vs Fundamental Analysis is a discussion that has been around for a long time regarding trading.

Both analyses are popular methods used by investors and traders to evaluate securities and assets. Also, both approaches have their own strengths and weaknesses, but which one is best?

Let’s start from the beginning!

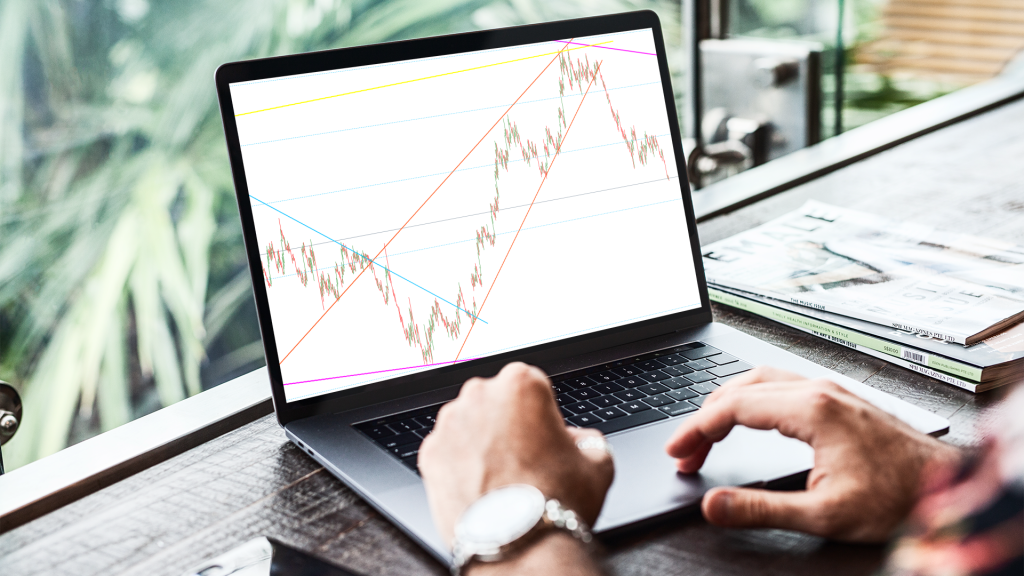

Technical analysis is a method of predicting the future price movements of a security based on its past performance. Technical analysts believe that the market is efficient, meaning that all available information is already reflected in the price of a security. Therefore, technical analysts focus on analyzing charts and other technical indicators to identify trends and patterns that can be used to make predictions about future price movements.

One of the key advantages of technical analysis is that it is objective and data-driven. In this type of analysis, technical analysts use a variety of tools and techniques, such as trend lines, moving averages, and oscillators, to analyze historical price data and identify patterns and trends. This can provide a clear and unbiased view of the market and help traders make more informed decisions.

However, technical analysis also has its limitations. One of the biggest criticisms of technical analysis is that it is based on the assumption that past performance is indicative of future performance. This assumption may not always be true, and relying too heavily on technical analysis can lead to inaccurate predictions and potentially costly mistakes.

Fundamental analysis, on the other hand, is a method of evaluating a security based on its underlying value. Fundamental analysts believe that the true value of a security is determined by the underlying factors that drive the performance of the company or asset, such as its earnings, revenue, and management. By analyzing these and other fundamental factors, fundamental analysts aim to determine the intrinsic value of a security and compare it to its market price.

One of the key advantages of fundamental analysis is that it takes into account a wide range of factors that can impact the value of a security. This can help investors make more informed decisions and avoid overpaying for a security. Additionally, fundamental analysis can provide valuable insights into a company’s long-term prospects and potential risks, which can be useful for investors with a long-term horizon.

However, fundamental analysis also has its limitations. One of the biggest criticisms of fundamental analysis is that it is subjective and can be subject to interpretation. Different analysts may have different opinions on the intrinsic value of a security, which can lead to disagreement and confusion. Furthermore, fundamental analysis can be time-consuming and require a significant amount of research, which may not be practical for traders who need to make quick decisions.

Both technical analysis and fundamental analysis are valuable tools for investors and traders. Technical analysis provides a data-driven, objective approach to analyzing securities, while fundamental analysis offers insights into the underlying factors that drive the performance of a security. That’s why many investors use a combination of both approaches in their decision-making process, as each can provide valuable insights and help to reduce risk.

Technical Analysis vs Fundamental Analysis: Which one do you think is best? Let us know!

Got a comment on this article? Join the conversation on Facebook, Twitter or LinkedIn and share your thoughts.

Amândio Luís

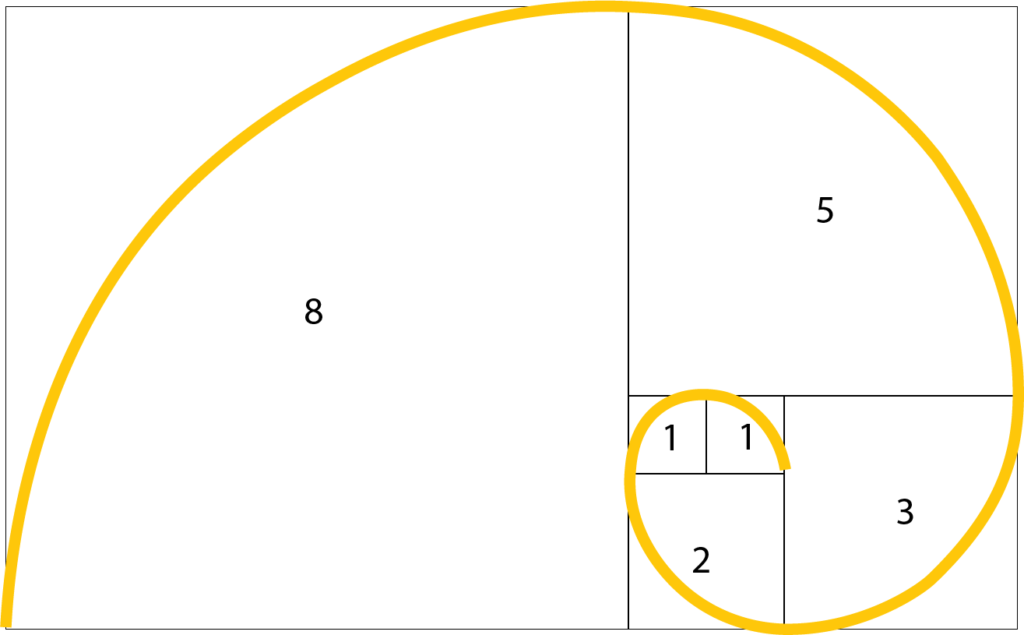

You may have never heard of the Fibonacci sequence, but it’s a mathematical formula that has been around for hundreds of years and is used to analyse financial markets. This article will explore the Fibonacci sequence and why it’s so important.

The Fibonacci Sequence is a series of numbers that starts with 0 and 1, and each subsequent number is the sum of the previous two. So, the sequence goes 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89… and so on indefinitely.

In 1202, an Italian mathematician named Leonardo Fibonacci published a book called Liber Abaci (Book of Calculation). In it, he introduced the Hindu-Arabic numeral system to the Western World. He also popularised a simple numerical sequence in which each number is the sum of the previous two (the Fibonacci sequence).

Well, the Fibonacci Sequence appears in nature quite often!

It can be found in the arrangement of leaves on a stem, the pattern of petals on a flower (typically come in sets of 3s or 5s), or even in spiral galaxies. Also, many animals have body parts that follow the sequence – for example, a rabbit has five toes on its front paws and three on its back paws.

It also has applications in mathematics, art, architecture and financial markets. For

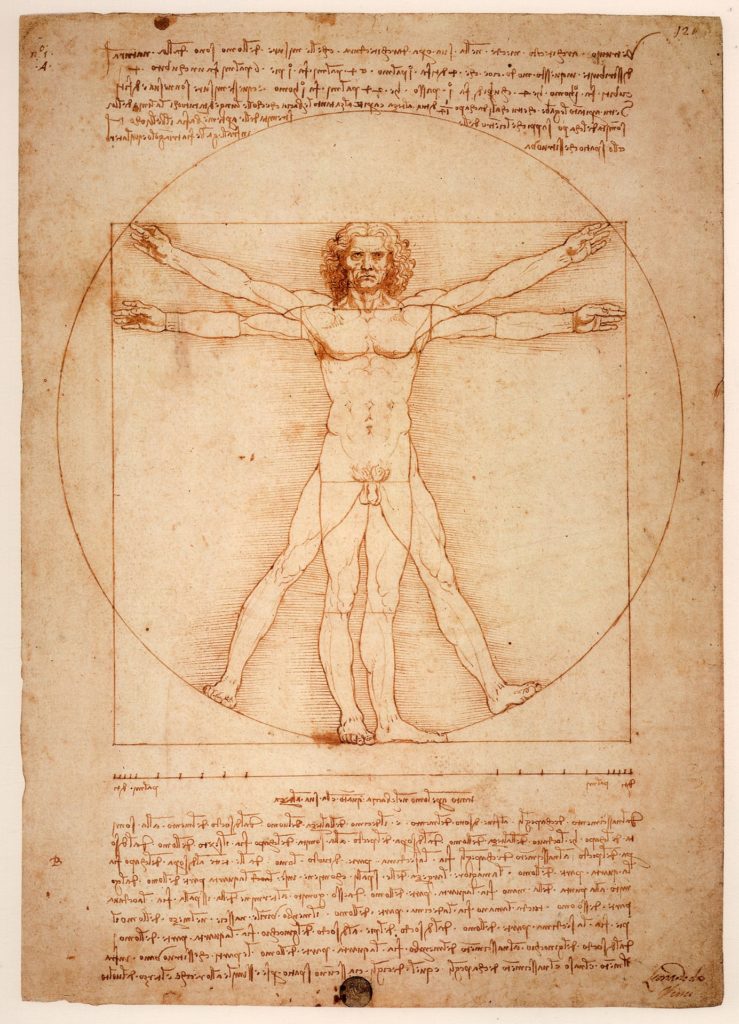

example, the golden ratio – is characterised by the fact that the quotient between any term in the series and the preceding term always tends to the same value (1.618) as you progress through the series. This proportion occurs often in nature and has been used by artists such as Leonardo da Vinci to create aesthetically pleasing compositions, like Mona Lisa and Vitruvian Man.

Golden ratio calculation/demonstration:

1/1 = 1

2/1=2

3/2=1,5

5/3=1.6666..

8/5=1,6

21/13=1,615348

13/8=1,625

34/21=1,61904

55/34=1,61764

89/55=1,161818

144/89=1,611798

If you enjoy maths, then learning about the Fibonacci sequence can be a fun and interesting way to explore a fascinating mathematical concept. Even if you don’t particularly enjoy maths, understanding the Fibonacci sequence can still offer some benefits. Here are a few reasons why learning about the Fibonacci sequence can be beneficial:

1. Help improve your problem-solving skills.

The Fibonacci sequence is all about patterns and relationships between numbers. Understanding it can help you become better at spotting patterns and solving problems in general.

2. Make you appreciate maths more.

Let’s face it: for many people, maths is not an enjoyable subject. However, the Fibonacci sequence is a perfect example of how maths can be beautiful and fascinating. Learning about it may just make you appreciate maths a little bit more.

3. Help you understand nature better.

The Fibonacci sequence is found throughout nature, from the arrangement of leaves on a plant to the spiral of a seashell. Understanding this connection between mathematics and nature can help you appreciate both subjects more.

In economics, several concepts are based on Fibonacci numbers, including Fibonacci retracements/expansion and Elliott Wave Principle.

These concepts help technical analysts to define more precisely the key points of trend changes and movement corrections, for example: if the market is moving up and then suddenly reverses direction, it might be because it has reached a Fibonacci expansion or retracement level. This level could be a support or resistance level that traders watch for clues about where the market is headed next.

Fibonacci levels are especially important to day traders who look for short-term opportunities in the market. By understanding how Fibonacci levels work, day traders can better predict when to enter and exit trades.

1. The use of the golden ratio is the secret of the world’s most resistant structures such as the Great Pyramid of Quéops ( Khufu ) built around 2560 B.C;

2. The seeds of a sunflower are usually arranged in two groups of spirals in the core of the flower: 21 clockwise and 34 counterclockwise;

3. If a person of average stature divides his height by the distance between his navel and his head, the result will be around 1.618;

4. As already mentioned, the Fibonacci sequence is found in Leonardo da Vinci’s “Mona Lisa” in the relationship between the torso and the head of the depicted figure as well as in the elements of the face;

5. Each block of the Egyptian pyramids is 1,618 times smaller than the one below it.

The Fibonacci sequence is a mathematical concept that has many applications in the real world. It can be used to predict population growth, calculate financial risks, and even understand animal proportions. While it may seem like a dry topic, understanding Fibonacci can provide insights into some of the most fascinating patterns in nature. So on this Fibonacci Day, take some time to learn about this incredible sequence and its far-reaching implications.

Got a comment on this article? Join the conversation on Facebook, Instagram, Twitter or LinkedIn and share your thoughts.

Amândio Luís

Amândio Luís

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| JSESSIONID | session | The JSESSIONID cookie is used by New Relic to store a session identifier so that New Relic can monitor session counts for an application. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| messagesUtk | 1 year 24 days | HubSpot sets this cookie to recognize visitors who chat via the chatflows tool. This cookie is used to recognize visitors who chat with us via the messages tool. If we chat with a visitor who later returns to the website in the same cookied browser, the messages tool will load their conversation history. |

| Cookie | Duration | Description |

|---|---|---|

| __hssc | 30 minutes | This cookie keeps track of sessions. This is used to determine if HubSpot should increment the session number and timestamps in the __hstc cookie |

| __hstc | 13 months | The main cookie for tracking visitors. It contains the domain, utk, initial timestamp (first visit), last timestamp (last visit), current timestamp (this visit), and session number (increments for each subsequent session). |

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site’s analytics report. The cookies store information anonymously and assigns a randomly generated number to identify unique visitors. |

| _gat | 1 minute | This cookie is installed by Google Universal Analytics to restrain request rate and thus limit the collection of data on high traffic sites. These are third party cookies that are placed on your device to allow us to use the Google Analytics service. These cookies are used to collect information about how visitors use our website. We use this information to compile reports. |

| _gat ok __hs_opt_out | 13 months | This cookie is used by the opt-in privacy policy to remember not to ask the visitor to accept cookies again. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visited in an anonymous form. |

| hubspotutk | 13 months | This cookie keeps track of a visitor's identity. It is passed to HubSpot on form submission and used when deduplicating contacts. |

| mautic_device_id | 12 months | Used by Mautic to track the Contact for either the tracking pixel or if the same key is not found in the brower's local storage for the monitored site. |

| tk_lr | 11 months | This cookie is set by JetPack plugin on sites using WooCommerce. This is a referral cookie used for analyzing referrer behavior for Jetpack |

| tk_or | 4 years | This cookie is set by JetPack plugin on sites using WooCommerce. This is a referral cookie used for analyzing referrer behavior for Jetpack |

| tk_r3d | 3 days | The cookie is installed by JetPack. Used for the internal metrics for user activities to improve user experience |

| Cookie | Duration | Description |

|---|---|---|

| oc_sessionPassphrase | session | No description available. |

| ocs09emfxnq1 | session | No description |

Technical Analysis vs Fundamental Analysis – What’s the difference?

Fundamental Analysis, Learning to invest, Technical Analysis Beatriz Costa 0